Useful Mac Apps

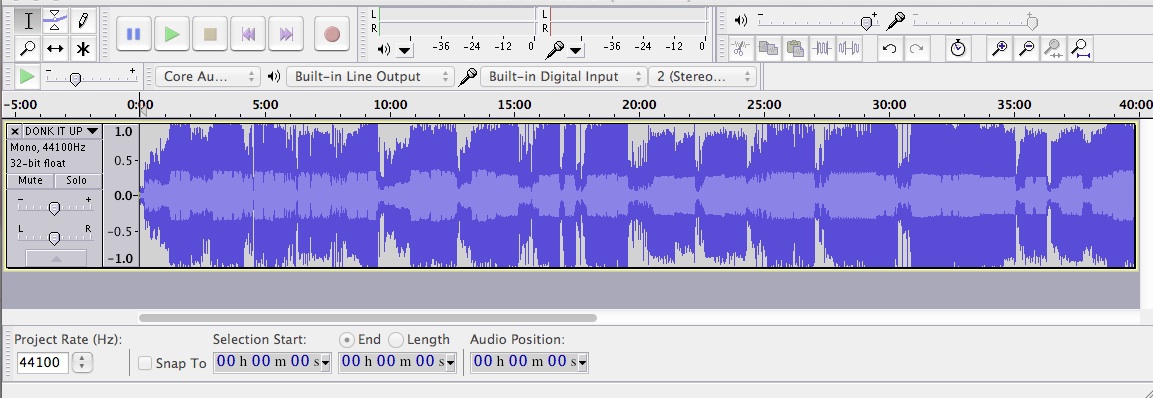

Audacity

Free, Mac X 10.4 and up

http://audacity.sourceforge.net/

The ultimate open source audio editor. Everyone should have basic knowledge of Audacity; which literally lets you edit any music file endlessly.

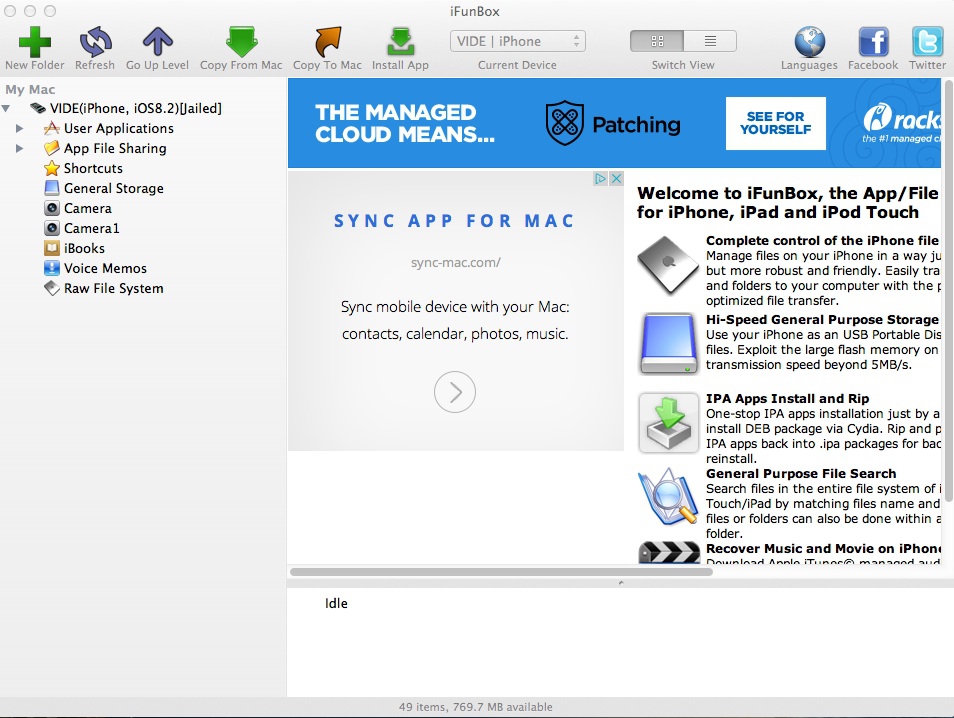

iFunBox

Free, Mac X 10.6 and up

http://www.i-funbox.com/ifunboxmac/

Easy to use file manager for Apple iDevices, if you're needing to get into file systems without jailbreaking your device.

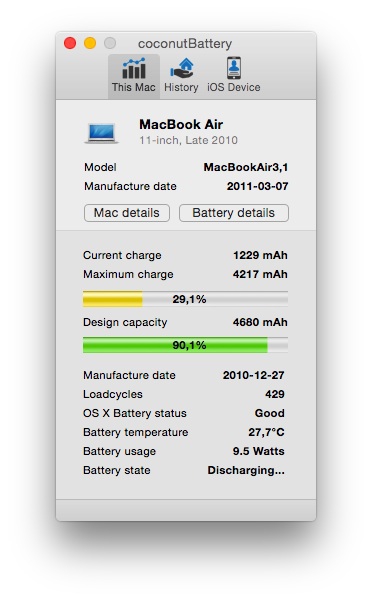

CoconutBattery

Free, Mac X 10.7 and up

http://www.coconut-flavour.com/coconutbattery/

Learn about you're laptops battery intelligently

CineBench

Free, Mac X 10.6 and up

http://www.maxon.net/pt/products/cinebench/overview.html

Measure your Mac's performance

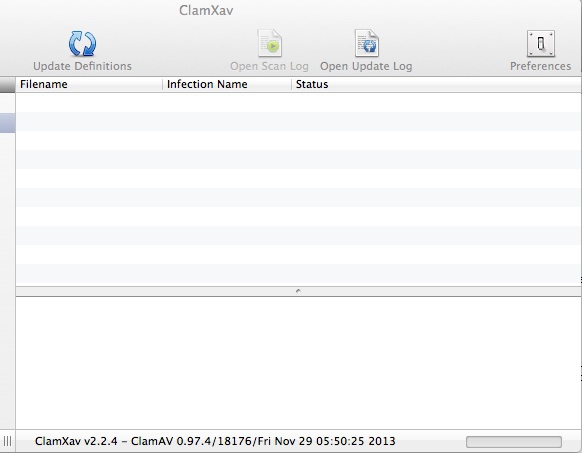

ClamXav

Free, Mac X 10.6 and up

https://www.clamxav.com/

Free malware scanner

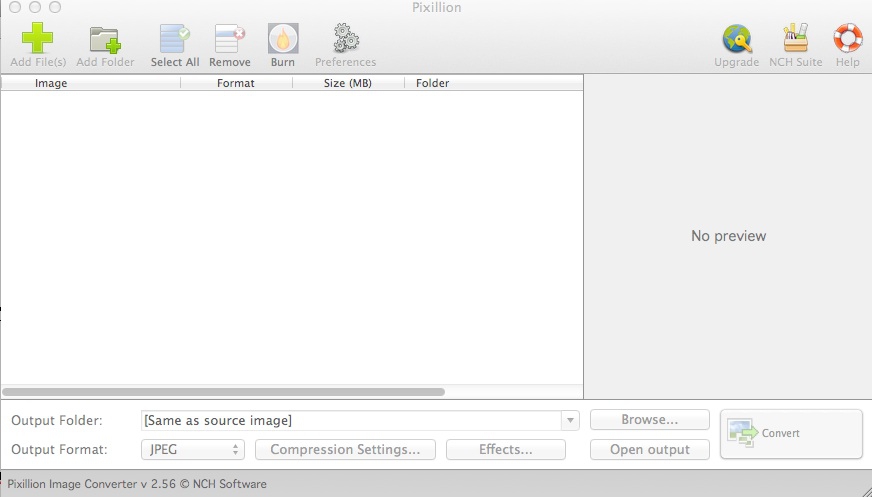

Pixillion

Free, Mac X 10.4 and up

http://www.nchsoftware.com/imageconverter/index.html

Free mass image converter for Mac

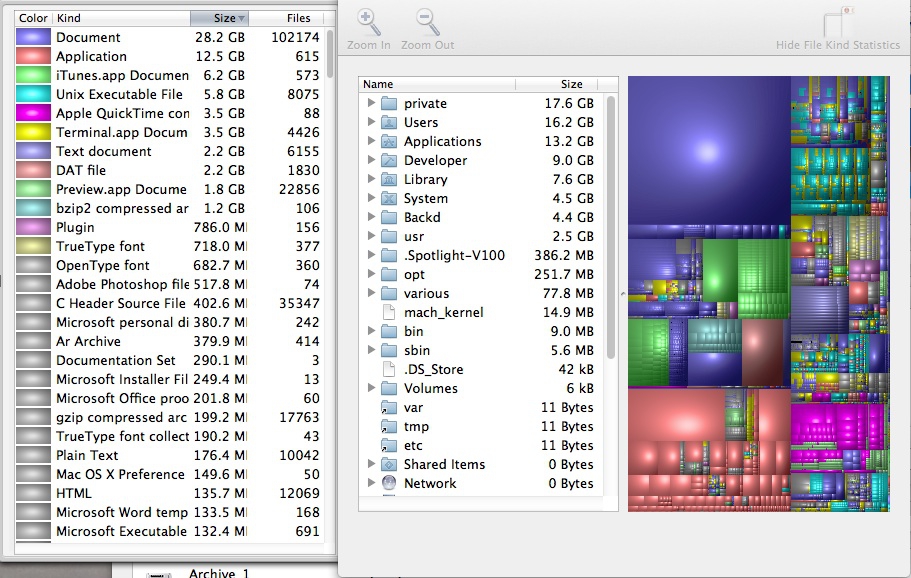

Disk Inventory X

Free, Mac X 10.3 and up

http://www.derlien.com/

Outstanding portable app that shows the sizes of files and folders on any drive

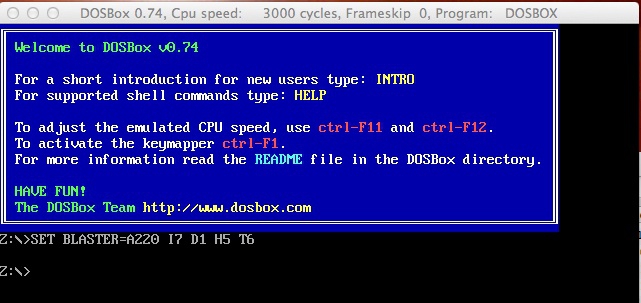

DosBox

Free, Mac X 10.6 and up

http://www.dosbox.com/download.php?main=1

x86 Emulator with DOS for Mac!

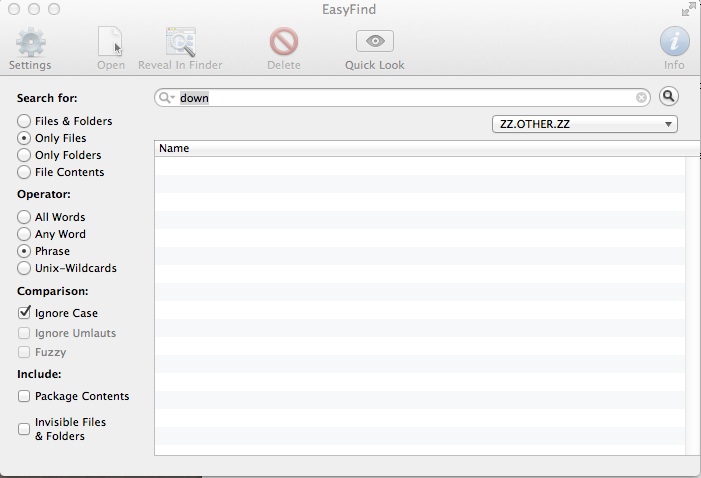

EasyFind

Free, Mac X 10.4 and up

http://www.devontechnologies.com/products/freeware.html

Better finder than the traditional mac Finder, and faster.

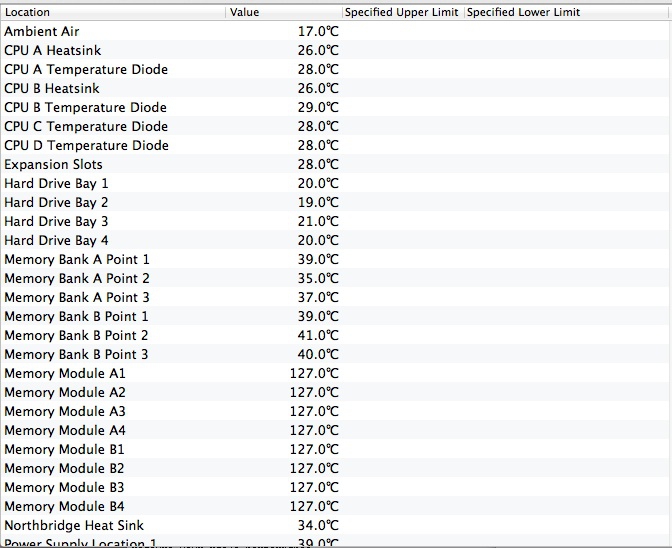

Hardware Monitor

Paid, Mac X 10.4 and up

http://www.bresink.com/osx/HardwareMonitor.html

A nice paid utility showing you all sensor outputs your Mac has.

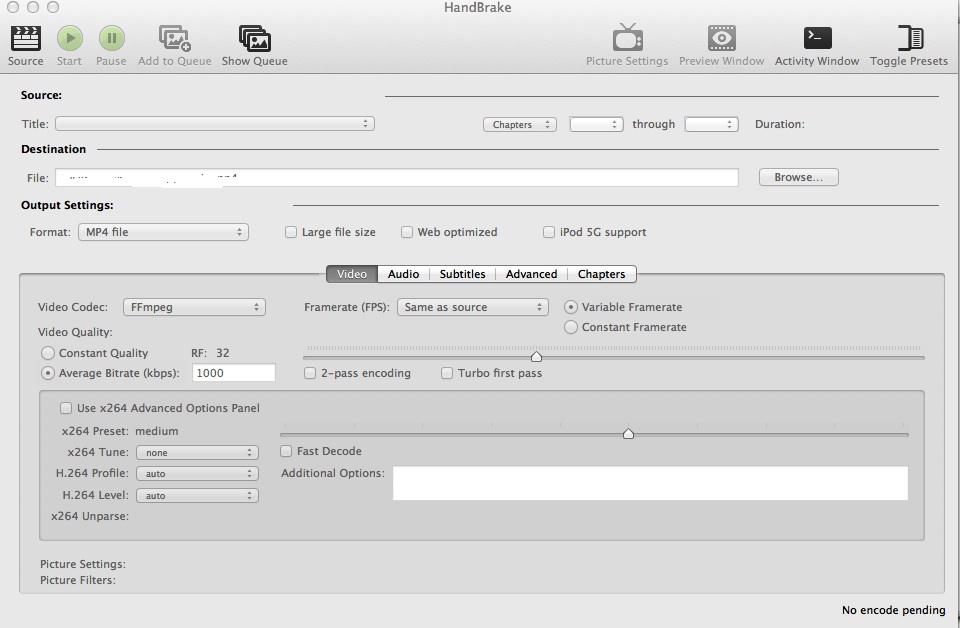

Handbreak

Free, Mac X 10.6 and up

https://handbrake.fr/

Free easy to use video conversion application

Paintbrush

Free, Mac X 10.4 and up

http://paintbrush.sourceforge.net/

The missing mac pain application!

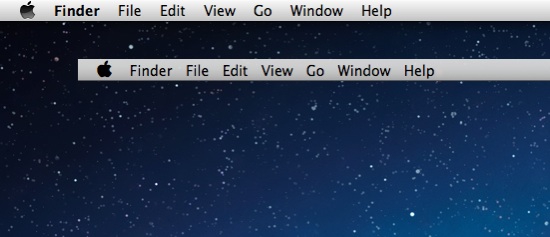

Second Bar

Free, Mac X 10.6 and up

http://boastr.de/SecondBar.zip

Extend another menu bar to any screen!

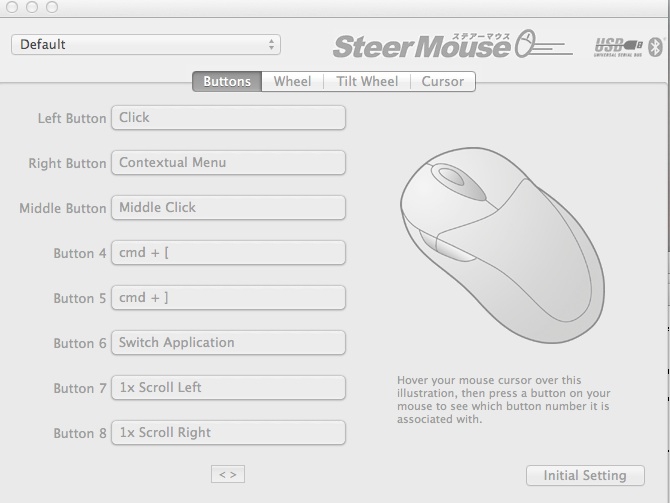

Steer Mouse

Paid, Mac X 10.4 and up

http://plentycom.jp/en/steermouse/

Precision mouse pointing for Mac. This is extremely useful for over clocking your mouses tracking speed the Mac OS pointlessly reserves.

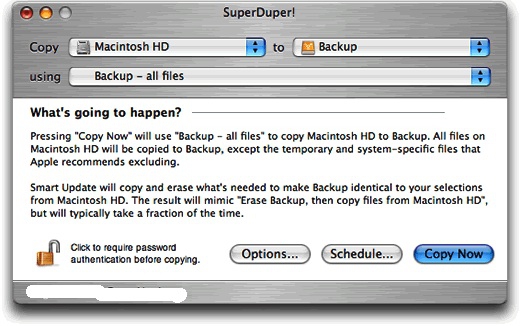

Super Duper

Paid, Mac X 10.6 and up

http://www.shirt-pocket.com/SuperDuper/SuperDuperDescription.html

Backing up your entire hard drive has never been easier. Super Duper does it in real-time while you can still use your system. Great utility for backing up full volumes when migrating.

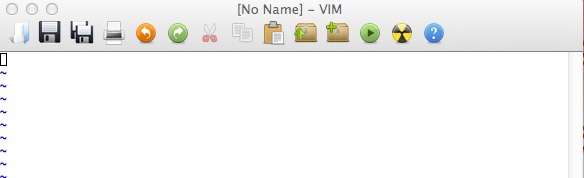

Mac Vim

Free, Mac X 10.6 and up

https://code.google.com/p/macvim/

Text editor 'vim' for Mac

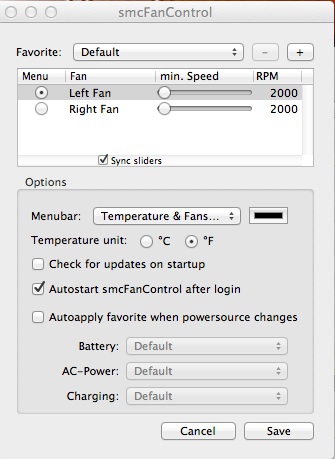

SMC Fan Control

Free, Mac X 10.6 and up

http://www.eidac.de/

Control fan speeds on your Intel Mac

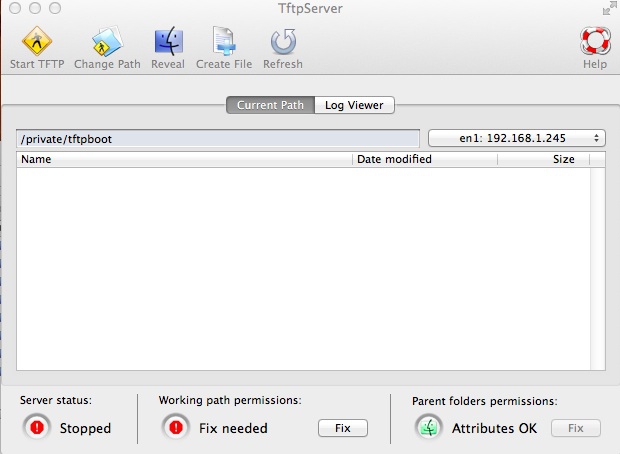

TFTP Server Mac

Free, Mac X 10.4 and up

http://www.macupdate.com/app/mac/11116/tftpserver

GUI to help setup Mac's built in TFTP Server

Taco HTML

Paid, Mac X 10.6 and up

http://tacosw.com/

Super light weight HTML editor. Very intuitive.

Tunnel Blick

Free, Mac X 10.4 and up

https://code.google.com/p/tunnelblick/

Open VPN GUI application for configuration files

Unrar

Free, Mac X 10.4 and up

http://www.unrarx.com/

Lightweight & fast unrar utility.

Wine

Free, Mac X 10.6 and up

http://winebottler.kronenberg.org/

The ultimate application to run Windows applications in MAC natviley. Comes with pre-installed packages like Internet Explorer and TextPad

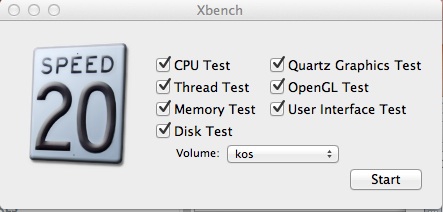

Xbench

Free, Mac X 10.3.9 and up

http://www.xbench.com/

One of the most comprehensive Mac benchmarking applications availiable

ZTerm

Free, Mac X Universal

http://www.dalverson.com/zterm/

Best terminal emulation for mac that's free

* Please use the comment form below. Comments are moderated.*

Comments